All Grown Up | Craft Beer is Now a Mature Market

On August 10, 2023, the Brewers Association issued a press release summarizing the craft beer industry midyear update from the Chief Economist, Bart Watson, where he expressed that things are still not great for craft beer, but also not quite as bad as they have been.

Even though a slight decline of -2% for this year-to-date indicates that business is not exactly rainbows and unicorns at the moment, he does believe that there are better days ahead for craft beer, especially for specific segments. This press release was followed up with a BA Collab Hour session with Watson that ventured further into current industry data and trends. The craft beer industry is now accustomed to receiving these types of data-heavy updates at various times throughout the year, but looking at the big picture on a multi-year scale, what does this mean for the industry in the long term? Have all those who have hinted at a “craft beer bubble” been right all along? Or is this simply a hard lesson about market maturity and economics? One thing is certain, this is not your mom/dad’s craft beer industry anymore, and considering that openings have slowed – but not decreased – our current market conditions truly are the new normal.

Signs Of A Maturing Market

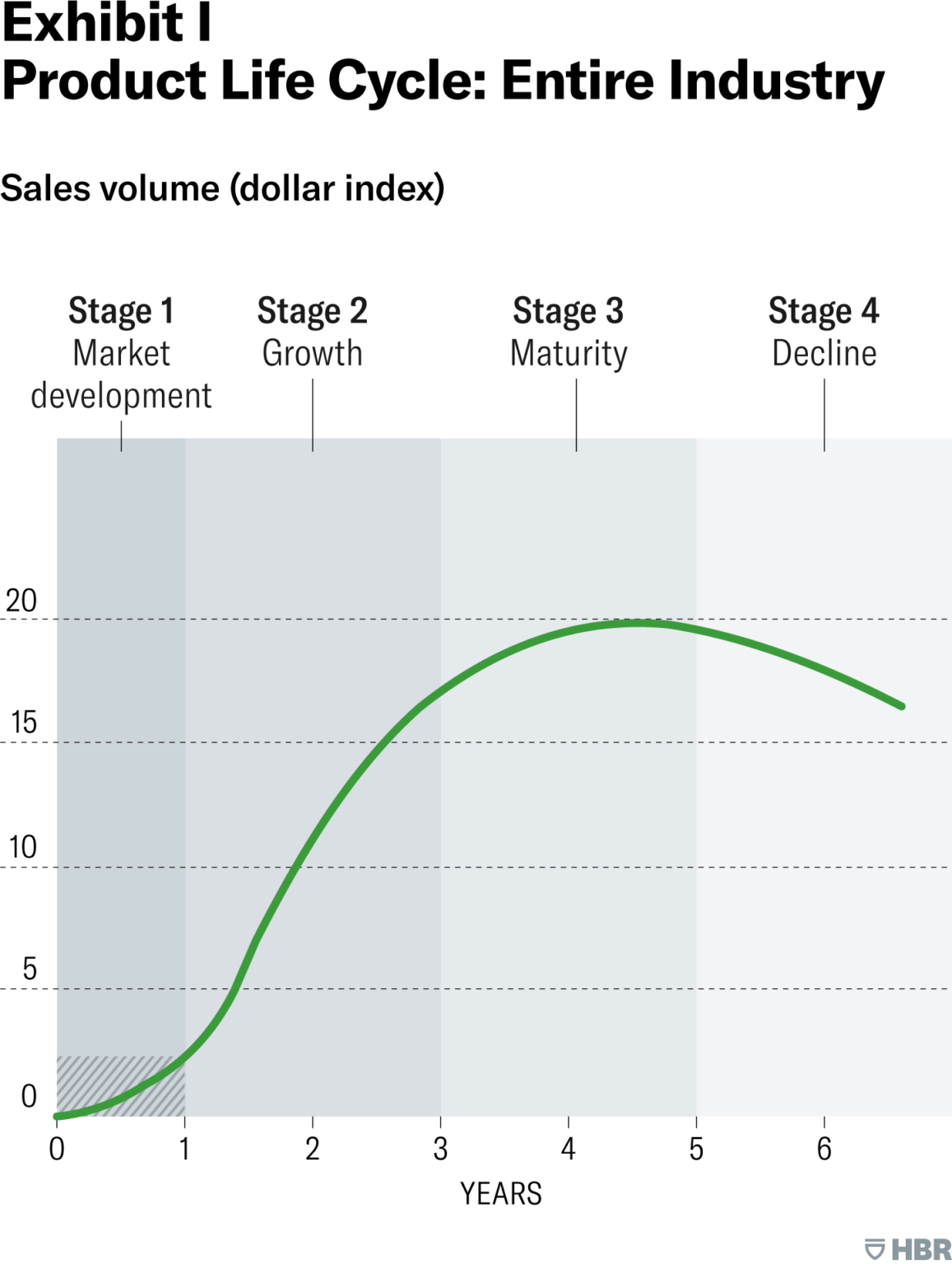

Every product that is sold to consumers has a life cycle. For the most part, there are 4 stages -– introduction or start-up, growth, maturity, and decline. The start-up or product development stage is marked by a world filled with unknowns, innovation, and the presence of competitors. This is where craft beer would be placed during the 1990s and early 2000s. Products that meet the needs of consumers are embraced, while others fall by the wayside. In this case, craft beer is a fairy tale story for many brands that came on the scene about 20-30 years ago.

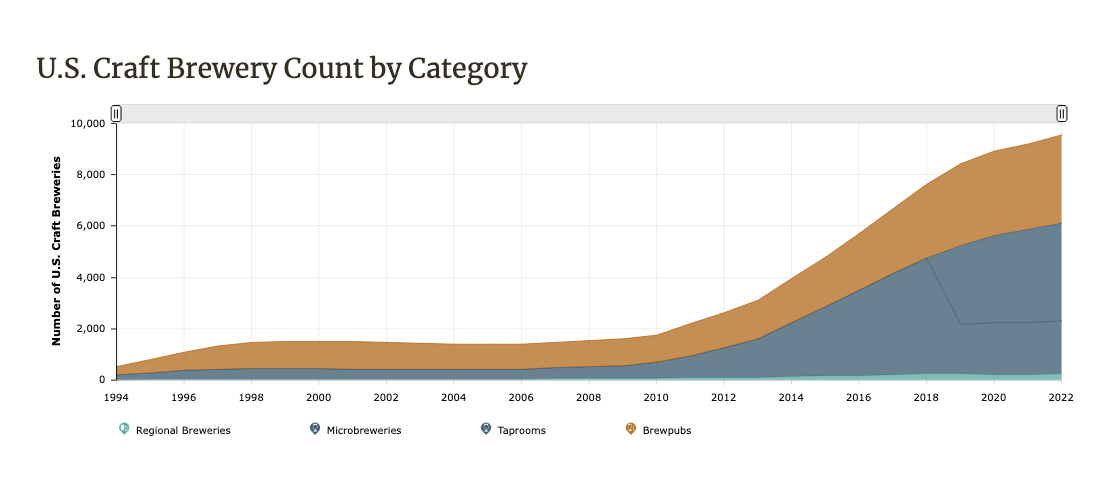

Moving into the 2010s, craft beer as an industry advanced into what is known as the growth stage of the product life cycle. At this point, sales are booming. New brands entering the market can do no wrong. Less work is required to build brand awareness as this new product is rolling with consumer trends and is in high demand. But while all seems rosy, the growth phase doesn’t last forever. In his article “Exploit The Product Life Cycle” for the Harvard Business Review, Theodore Levitt states “As the rate of consumer acceptance accelerates, it generally becomes increasingly easy to open new distribution channels and retail outlets. The consequent filling of distribution pipelines generally causes the entire industry’s factory sales to rise more rapidly than store sales. This creates an exaggerated impression of profit opportunity which, in turn, attracts more competitors. Some of these will begin to charge lower prices because of later advances in technology, production shortcuts, the need to take lower margins in order to get distribution, and the like. All this in time inescapably moves the industry to the threshold of a new stage of competition” (Harvard Business Review 1965). With the meteoric rise of craft brewery openings in the mid-2010s, one can see that this is exactly how the marketplace unfolded.

Craft beer as an overall industry has now entered what is called the maturity stage of its product life cycle. There is no bubble, but there is a lesson to be learned about market cycles. This phase is characterized by market saturation, limited distribution channels, fierce competition for shelf space, a greater need for brand differentiation, and increased direct consumer communication (i.e. marketing). Sometimes the maturity phase is fleeting, like with fashion trends, but for other product segments, like beer, this phase can continue for many years. But eventually, some brands will find themselves in the next stage of their product life cycle – decline. As craft beer fans watch in astonishment as some of their go-to “old school” craft breweries have to make major changes to their business models or shutter their doors, this is not an unusual occurrence in the context of product life cycles. Consumers get bored, and they move on to something new, but for brands that can figure out the magic recipe for innovation and consumer loyalty, the brand can continue to flourish.

The Red Flags

There are clues in the craft beer environment of today that indicate the industry is already in the throws of a mature market phase. In the Brewbound news segment “3 Up and 3 Down” co-hosted by the analytics and consulting firm 3 Tier Beverages out of Chicago, team consultant Stephanie Roatis shared on the most recent episode that “craft’s total points of distribution (TDP) declined -2.1% in the latest 52 weeks, and volume remains down -2.3%” and “liquor channel total beer dollar sales, which make up roughly 8% share of total off-premise sales, remain down -1.2% in the latest period” (Brewbound, August 2023). Combine this with Brewers Association stats that On-Premise draft sales have never really recovered from the shutdowns of 2020 – things are not looking exceptionally bright for craft beer brands heading into the future.

Innovation, which is the concept that most brands turn to in times of maturity and decline, is also an issue for craft brewers. On one hand, the consumer is clamoring for more innovation, but on the other, the wholesalers want less (or at least more calculated innovation). And this trend is also carrying over into the direct consumer channel. For Paste magazine, Jim Vorel declares that “On the most basic level, the craft beer landscape has simply felt trapped in stylistic stasis in recent years, a far cry from the previous era of new discovery and growth that was fueled in the 2000s and 2010s by a market in which it was so much easier to turn a profit…It’s difficult to look at the craft beer scene’s still-recent past without donning rose-colored glasses in many respects. To be certain, there’s always been a proliferation of bad beer and chintzy breweries in the American craft beer industry, companies that have latched on to each wave of growth and relied on a rising tide to lift their boats. But at the same time, I don’t think it’s unrealistic or entirely rooted in nostalgia to say that the experience of being a nascent beer geek/consumer was simply more rewarding a decade ago than it likely is today” (Paste, August 2023). The typical craft beer consumer is aging, their preferences are changing, and their economic situations are evolving, and the sooner that craft beer brands recognize this, the more agile they can be with their business plans.

Changes Ahead

So as the craft beer landscape continues to evolve, brands can expect to see changes in the marketplace that are indicative of a fully mature market – crowded shelves, demand for calculated innovation, and the curation of increased brand loyalty. And these changes will be felt at all levels of the 3-tier system. “Own Premise” consumption is actually rising, so the taproom business is looking pretty good at the moment, which should be great news to owners and operators considering the profit margins are healthier than in the wholesale channel. On the flip side, the squeeze in the wholesale channel will continue as brands can expect to see national chains consolidate their craft beer sections due to declining velocity metrics. Bump Williams, president and CEO of Bump Williams Consulting, wrote in the company’s monthly update that “I’ve said this many times in the past, ‘The most sensitive nerve in the human body is the one attached to the wallet’ and some hard decisions are being made today that will impact facings, the share of shelf, space, display inventory, cooler door presence, and SKU-count this Fall” (Brewbound, August 2023). Williams goes on to explain that business savvy craft brands would be wise to pay attention to package and style trends in order to avoid “knee jerk” decisions that could alter the course of their distribution footprint. The recent press release from the BA suggests that “overall, craft brewers continue to face economic headwinds on both business and consumer fronts”, but Watson wants the industry to know that “optimism is on the horizon as the midyear survey shows hope for better trends in the future. Collectively, craft beer still needs new ideas and new strategies to move beyond our current normal, which is a slow-growth environment. Craft demand isn’t going anywhere, and there is plenty of opportunity for growth within new channels, occasions, and customers” (Brewers Association, August 2023). It’s looking like the “new normal” of the craft beer industry is turning out to be a bit more complicated than anyone realized. The gift of foresight is invaluable, but no one has a craft beer crystal ball. The best that brands can hope for is to recognize the mature market phase of craft beer and act accordingly – adjusting business models, engaging in strategic planning, making data-driven decisions, and paying close attention to market trends.

Submit a Comment