State of the Craft Beer Industry Report

After surviving a dismal Q1 of 2022, the craft beer industry can finally breathe a sigh of relief and look forward to more sunny skies for the remainder of 2022. A recent smattering of craft beer industry updates from trade associations, allied trade partners, and data aggregates are providing craft breweries more light at the end of their pandemic market tunnel. The general consensus is optimistic, whether it’s Bart Watson from the Brewers Association relaying his confidence about 2022 for craft brewers or 76% of craft brewers themselves waxing positive about sales growth this year in the 2022 Brewing Growth Trends Report from Arryved. It’s time to break out your sunglasses beer folks, let’s take a look at the brighter state of the craft beer industry (with some occasional clouds) heading into the remainder of 2022.

Sunny skies ahead

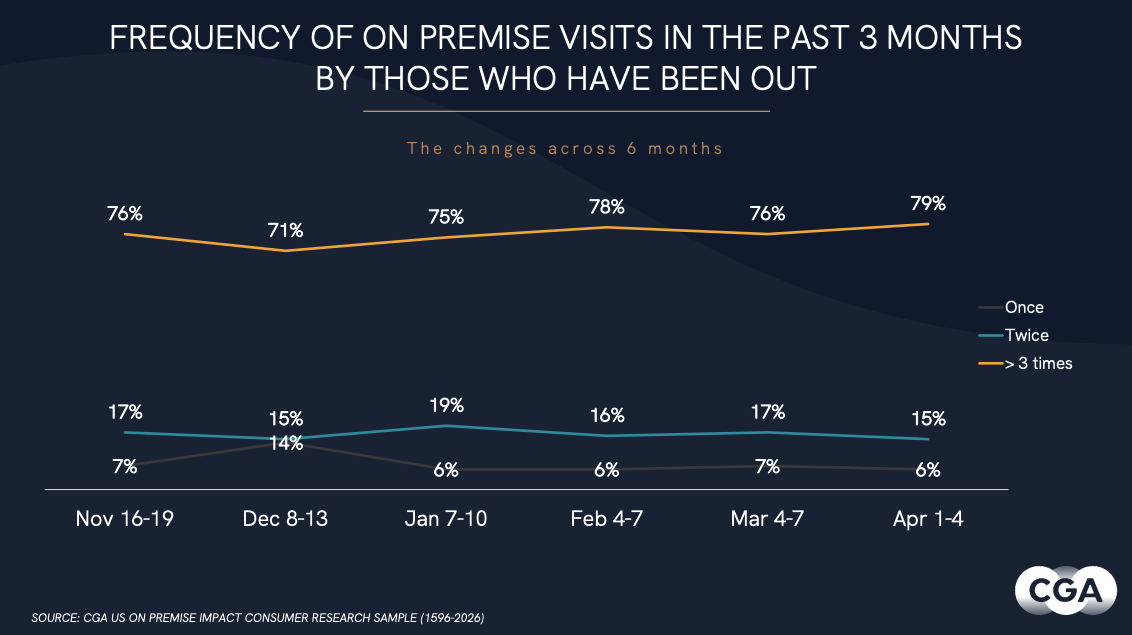

Q2 and Q3 of 2022 should bring sunshine and rainbows to the craft beer industry in the form of an uptick in On-Premise retail sales. Reopening is a buzzword familiar to most. Most states have lifted all occupancy restrictions on service establishments, resulting in rising consumer confidence to visit the On-Premise channel. Intelligence company Beer Board, reports that craft beer is up 8.1% in monthly draft volume through the end of Q1 2022 within On-Premise retail accounts. Nielsen CGA, a sales data intelligence company that covers the intricacies of the On-Premise beverage alcohol market, has shown that consumers are flocking to On-Premise outlets again, which is great news for taprooms, as well as craft beer brands that are selling products in the wholesale channel. When consumer confidence is high for specific market channels, beer suppliers can reasonably assume that sales will increase.

But of the consumers that are spending money on the On-Premise channel, what are they drinking? While demographics are not the end-all-be-all of consumer trends, it’s significant for craft beer industry members to note the specific age groups that have the most purchasing power. Nielsen CGA reports that Gen Z drinkers (ages 21-34) head out to the On-Premise more often than any other LDA (legal drinking age) group, but craft beer brands shouldn’t sleep on Millennials. LDA consumers ages 35-44 might not head out on the town as much as their younger counterparts, but they do spend more money on beverage alcohol collectively. Acknowledging the purchase habits of specific age groups can assist craft brewers with their sales and marketing efforts.

In the realm of overall drinking habits of LDA consumers, craft beer is taking a backseat to spirits, with tequila being the drink of choice for most in the form of mojitos and margaritas, but also seen more recently as a premium sipping spirit served neat. This also wouldn’t be a comprehensive craft beer industry report without the mention of the meteoric rise of RTD (ready-to-drink beverage) consumption trends. These convenient, cost-effective beverages are definitely on the same growth path that hard seltzer experienced over the past few years, and their presence in the On-Premise channel is becoming more and more commonplace.

Shifting from consumer confidence to wholesaler confidence, the Beer Purchasers Index (BPI) is released monthly by the National Beer Wholesalers Association (NBWA) and measures the levels of product orders from beer distributors nationwide. An index of 50 or more within a particular beverage alcohol category means that product type is in demand, while a rating of 50 or less means that product might be in decline. The March 2022 BPI for craft beer came in at a solid 47, which is reminiscent of last March’s rating of 46, but oh so close to that 50-yard line that everyone in the industry hopes to see very soon.

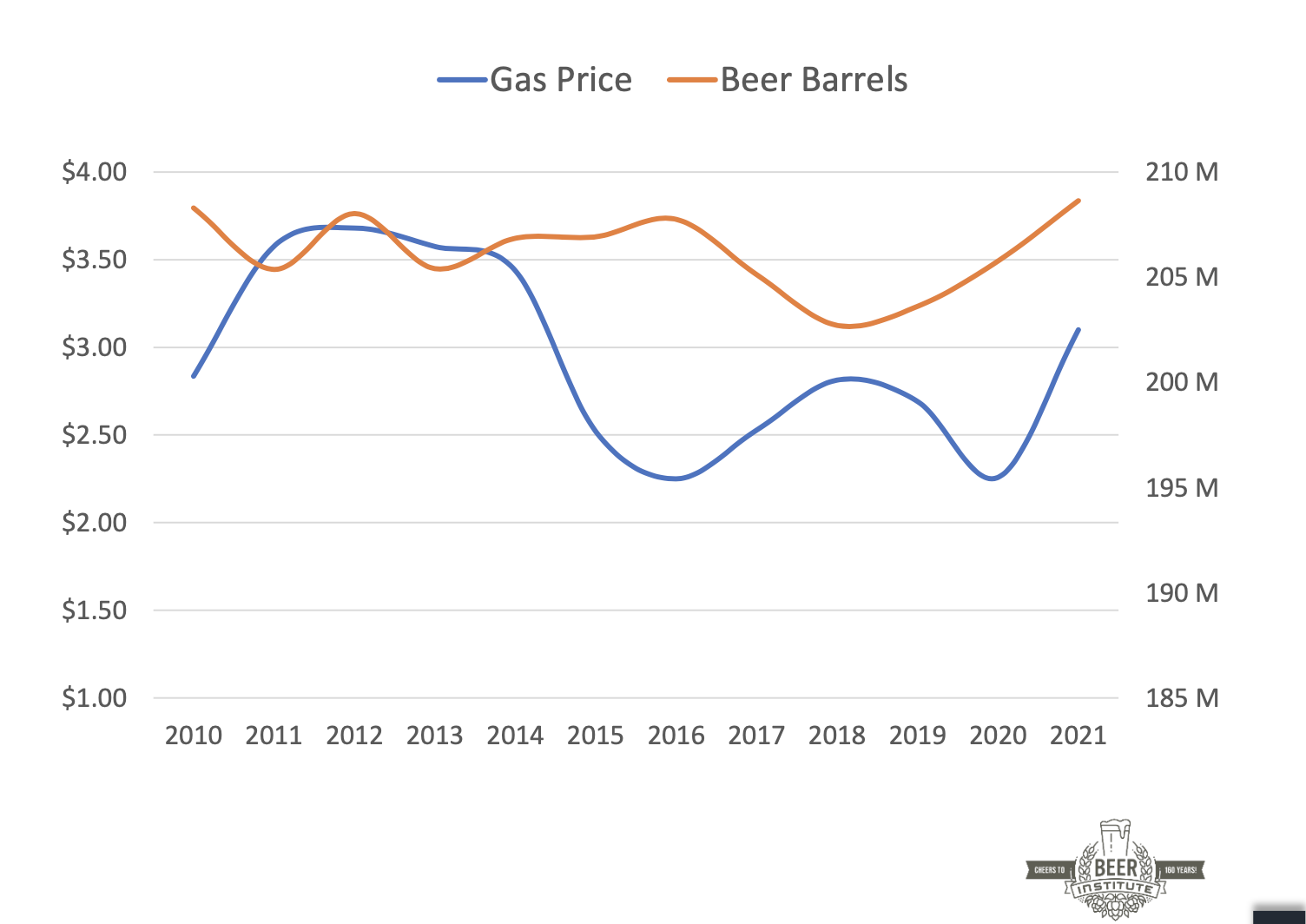

Don’t put your umbrella away yet

According to data from the Beer Institute, the On-Premise market has not yet recovered to pre-pandemic levels and is still operating at about a 20% deficit. Data mining juggernaut Vermont Information Processing (AKA VIP) has also reported that there are 40,000 fewer On-Premise accounts that are actually open in 2022 versus 2021. So while things are looking up and the rate of sales are on the rise, craft breweries would be wise to keep in mind that they aren’t out of the clouds just yet. There are plenty of indirect market factors at play that will affect beer sales. Jonathan Jones of Nielsen CGA states that “rising costs are squeezing many consumers’ disposable incomes, and high COVID-19 numbers mean significant numbers remain hesitant about going out. Inflation is piling pressure on businesses as well, and while the long-term outlook for the drinking-out market remains good, there are clearly more turbulent times ahead.” Factors like inflation, supply chain challenges, political unrest, labor shortages, local and state regulations of our market, category substitutions, and distributor consolidation in the middle tier are all volatile elements that will impact craft brewery sales in the upcoming months, as demonstrated by the Beer Institute’s correlation between rising gas prices and overall beer volume.

Turbulence in the Off-Premise

Moving on to the darling of pandemic-era sales for most craft beer brands, let’s see what’s rumbling in the world of Off-Premise sales for 2022. Sunglasses are probably not the most fitting accessory for this year’s Off-Premise outlook, but sunscreen might be a great investment. According to SipSource, a national beverage alcohol reporting system for aggregated distributor and retailer sales data, Off-Premise craft beer sales are still significantly up across all metrics compared to 2019, but down versus 2021. Consumer pantry loading metrics from 2020 and changes in consumer purchase habits are all explanations for why the craft beer industry overall might see downtrends in Off-Premise sales in 2022, but only for the sheer fact that they are trending off huge spikes of sales from pandemic market conditions. In other good news, craft beer continues to dominate shelf share in the cold box, according to studies from the Beer Institute released in a recent press conference, which also revealed that the Off-Premise outlets having their moments in the sun include convenience stores, grocery, liquor and package stores, and mass merchandise.

Now here’s where the craft beer industry needs that extra protection – there are multiple factors that will affect Off-Premise sales of craft beer, including the number of brands in distribution, state of the middle tier, beverage category substitutions, inflation, and state and federal regulatory requirements in Direct To Consumer sales. In the 2022 Arryved Study of Craft Brewing Growth Trends, 21% of current craft breweries plan to increase distribution in retail for their products this year. If brewery businesses thought the competition was tough during 2020 and 2021, just wait, there’s more to come. More brands entering the craft beer market is wonderful for the small and independent industry segment overall, but more brands in distribution mean the already stretched minds of beer distributor personnel and retail buyers will enter a new stratosphere and could mean less mind share for smaller, growing craft beer brands.

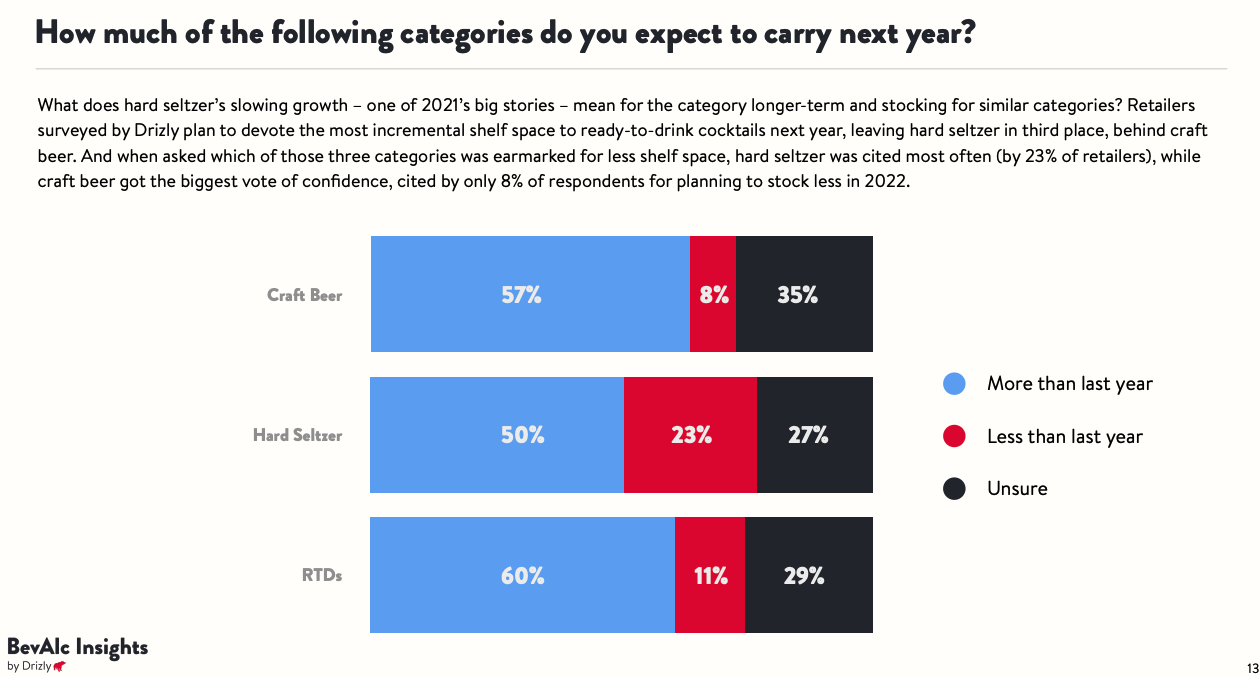

Off-Premise market data is a bit easier to track than On-Premise, so luckily there are plenty of statistics to digest to make reasonable assumptions about this year’s Off-Premise outlook. BevAlc Insights from Drizly is a great resource to track consumer and retail buyer preferences in the Off-Premise. In their 2021 Retail Report, not only are Off-Premise retail buyers planning to stock more craft beer in 2022, but as demand softens for hard seltzer, they are looking to replace those shelf spots with more craft beer brands and RTD beverages.

Cautious Optimism

Consumer category curiosity and the increase of “beyond beer” drinks available in the Off-Premise will impose a threat to craft beer market share overall. Nielsen IQ reported 52 weeks of RTD sales ending January 2022 at $9.6B, up from $3.8B in 2018. “The outlook for beer remains challenging into the future as the heightened level of consumer choice will continue to sway beer drinkers into competing categories,” says Adam Rogers, the North American research director at IWSR Drinks Market Analysis.

In addition to the squeeze on the shelf from competing brands and drink categories in Off-Premise, craft breweries should take into consideration the purchasing power of specific consumer segments, rising price points, and the state of online beer sales. Off-Premise consumer category trends for the craft beer industry mirror that of the On-Premise. According to Drizly BevAlc Insights, Gen Z beer purchasers comprise about 21% share of the beer market compared to other generations, but Millennials still come through strongly with their overall spending power and lack of price sensitivity. “Millennials are more open-minded when it comes to purchasing alcoholic beverages, and are not as brand-dependent as older generations,” notes Gillian Sciaretta, the wine buyer at New Jersey-based Gary’s Wine & Marketplace. “They are also more about quality over quantity, and are willing to spend more when purchasing a product.” As market prices for craft beer rise due to the increasing cost of goods sold, the lack of price sensitivity becomes extremely important for forecasting future sales. Beer costs rose 2% between January and February 2022, but brewers worldwide expect things to rise even more by the end of the year. Bart Watson from the BA recently warned that due to “packaging increases, labor cost increases, supply chain cost and shipping increases, barley, and malt increases…we’re starting to see that translate into consumer prices.” Double-digit inflation on raw materials and rising fuel prices will dictate higher price points in the craft beer market this year. While increases are inevitable, they will be brand-specific, so ultimately it’s up to owners/operators to find a balance between what the market will bear and what prices they need to hit to stay in business. And finally, while the state of online beer sales and DTC options remain fuzzy at best, the craft beer industry should keep its eye on the state and federal-level regulatory evolutions that could loosen restrictions on shipping and intrastate commerce. Historically beer has been late to the eCommerce game, not for lack of trying, but because beer logistics and legislation are drastically different than our wine, cider, and spirits counterparts. But being in the back of the pack is not a bad thing according to Adam Rogers of the IWSR, “Sales of beer online will continue to increase year-over-year due to the category being less representative in the growing channel,” says Rogers, adding that beer, cider, and RTDs “are forecasted to collectively increase volumes at a category annual growth rate of 39 percent through 2025, outpacing wine and spirits growth due to lower base size.”

The overall forecast for the craft beer industry in 2022? Mostly sunny with a chance of occasional showers. Craft beer as an overall CPG segment did grow its market share in the industry from 12.2% in 2020 to 13.1% in 2021, according to the recent 2021 Annual Report from the Brewers Association. This same report also provided more brewery openings than closings, which is beneficial for the industry overall. And this same report showed that craft beer dollars grew by 21% over 2020, which should spark hope for anyone in the craft beer industry leading into the rest of 2022. Within this same report, the BA also publishes its annual list of brewery and craft brewery rankings based on sales volume. The usual suspects graced the list, but some points of significance to note are that 40 of the top 50 beer brands by sales volume are small and independent breweries, and the appearance of Athletic Brewing Company, the NA mover and shaker, at spot #27 on the craft list. Product line expansion aspirations anyone? Maybe something to consider over your next pint.

Submit a Comment